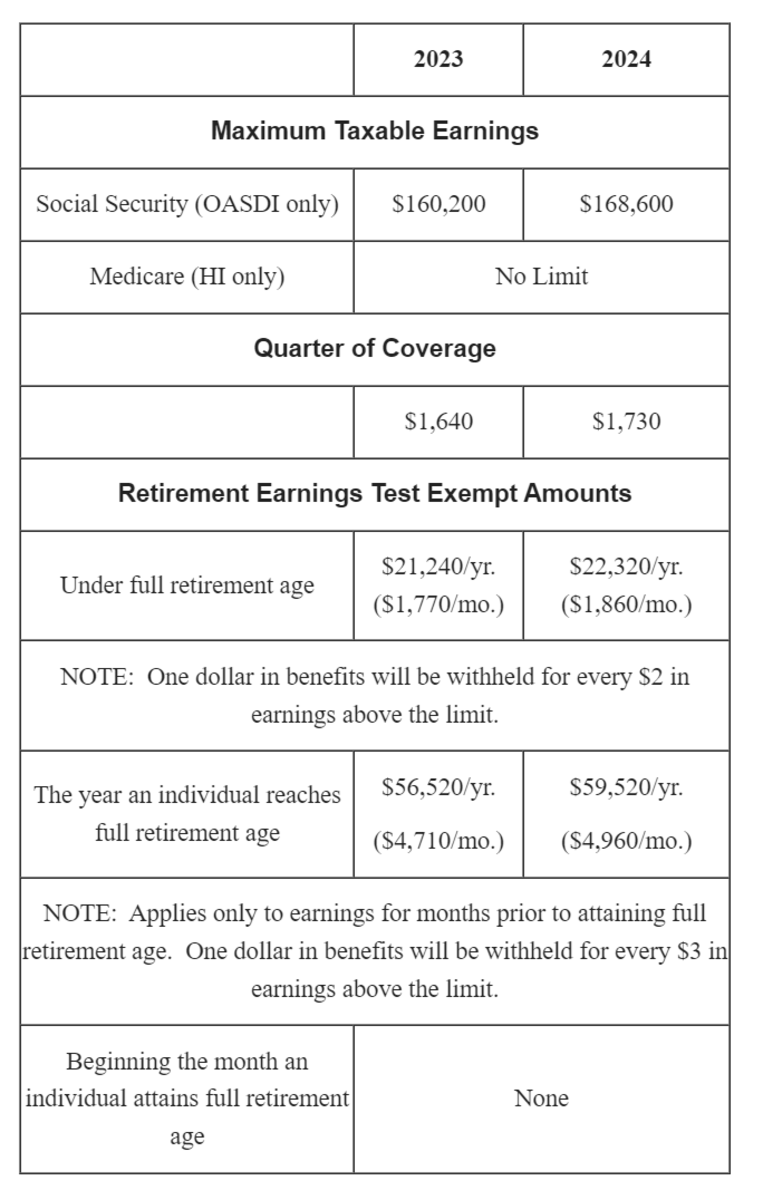

Social Security Tax Maximum 2025 - SOCIAL SECURITY UPDATE 168,600 New Social Security Maximum Taxable, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20; Cola, my social security, my social security account. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

SOCIAL SECURITY UPDATE 168,600 New Social Security Maximum Taxable, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20; Cola, my social security, my social security account.

Maximum Social Security Benefit 2025 Calculation, That’s what you will pay if you earn $168,600 or more. As a result, the maximum social security tax jumps from $9,932 to $10,453.

Social Security and SSI Benefits To Increase 3.2 in 2025 Retirement, The absolute maximum social security benefit in 2025 is $4,873 monthly, more than double the estimated average of $1,907 retirees receive across the nation as. We call this annual limit the contribution and benefit base.

Up to 50% of your social security benefits are taxable if: For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000).

6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20;

This amount is known as the “maximum taxable earnings” and changes.

168,600 New Social Security Maximum Taxable Earnings in 2025 YouTube, The maximum social security benefit for 2025 is expected to be $3,822 per month at full retirement age. The 2025 and 2025 limit for joint filers is $32,000.

Max Social Security Tax 2025 Dollar Amount Calculator Sydel Sarene, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. For 2025, the social security tax limit is $168,600.

Social Security Tax Maximum 2025. For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000). The most you will have to pay in social security taxes for 2025 will be $10,453.

Max Social Security Tax 2025 Dollar Amount Calculator Sydel Sarene, For 2025, the social security tax limit is $168,600. For 2025, an employer must withhold:

Limit For Maximum Social Security Tax 2022 Financial Samurai, That’s what you will pay if you earn $168,600 or more. Cola, my social security, my social security account.

5.2 Increase to Social Security Maximum Taxable Earnings in 2025 YouTube, Irs reminds taxpayers their social security benefits may be taxable | internal revenue service. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Social Security Tax Limit 2025 Here Are The Pros And Cons, The initial benefit amounts shown in the table below assume retirement in january of the stated year, with. That’s what you will pay if you earn $168,600 or more.

Social Security Maximum Taxable Earnings 2022 2022 DRT, That’s what you will pay if you earn $168,600 or more. For 2025, the social security wage base was $168,600.

For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000).