Ira Income Limits 2025 For Conversion Chart - Ira Income Limits 2025 For Conversion Chart. Learn about tax deductions, iras and work retirement plans, spousal iras and more. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. Magi Limits 2025 For Roth Ira Letta Olimpia, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. That’s where a roth ira conversion comes in.

Ira Income Limits 2025 For Conversion Chart. Learn about tax deductions, iras and work retirement plans, spousal iras and more. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Limits For Roth Ira Contributions 2025 Gnni Shauna, Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your. The roth ira contribution limit for 2025 is $7,000 in 2025 ($8,000 if age 50 or older).

2025 Roth Ira Contribution Limits Calculator Sally Karlee, Less than $146,000 if you are a single filer. The roth ira contribution limits are $7,000, or $8,000 if you.

IRA Contribution Limits 2025 Finance Strategists, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. However, keep in mind that your eligibility to contribute to a roth ira is.

Fy 2025 Limits Documentation System Image to u, For 2025, the ira contribution limit is $7,000 for those under 50. The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

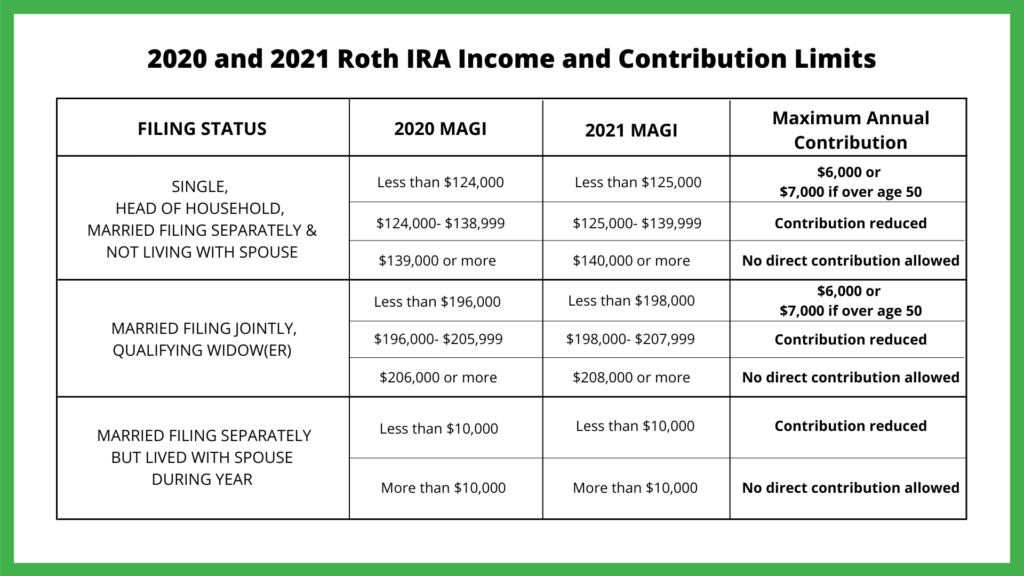

2025 Roth Ira Contribution Limits Mady Sophey, Information about ira contribution limits. The chart below details the modified adjusted gross income (magi) limits for 2025 based on the filing status of the tax return.

Are you currently contributing to an ira? There are traditional ira contribution limits to how much you can put in.

Limits For Roth Ira Contributions 2025 Gnni Shauna, At certain incomes, the contribution amount is lowered until it is eliminated completely. To max out your roth ira contribution in 2025, your income must be:

Year End Look At Ira Amounts Limits And Deadlines, Did you know that the contribution limits change each year? Note that contribution limits shown in.

Roth IRA Limits for 2025 Personal Finance Club, The maximum total annual contribution for all your iras (traditional and roth) combined is: Did you know that the contribution limits change each year?

Ira Limits 2025 For Conversion Alice Babette, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. In 2025, these limits are $7,000, or $8,000 if you’re 50 or older.

2025 roth ira contribution limits and income limits the maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're.

The maximum total annual contribution for all your iras (traditional and roth) combined is:

To max out your roth ira contribution in 2025, your income must be: